Discussion - Member to Member Sales - Research Center

Discussion - Member to Member Sales - Research Center

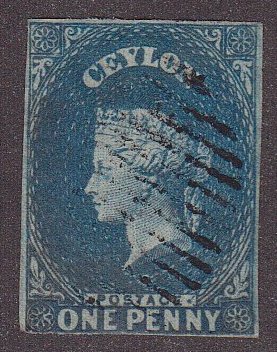

He asked me to help with this promisary note. It's franked with Scott R1, R20c, and R36c (I'm assuming no valuable paper varieties). On eBay, promisary notes seem to be priced low except for the tall revenues. The CV for these three as unsed stamps is $3.70. does anyone know if being on note brings the price up significantly, and how much? Any help is appreciated.

David

Login to Like

this post

David.

I sent an email, with a copy of this post, to a friend of mine in Mass. who specializes in US revenue B.O.B. stamps.

If he is able to shed any light on this, I will post his response to this thread.

Login to Like

this post

It would be my thought that ordinarily for revenue stamp usage that there would not be that much of a value increase for the stamp on piece. Of course if you had a famous person's or company name on the document, then you'd probably get a bump in value.

Revenue stamps up to December 25, 1862 could only be used on the document, instrument, etc. that the stamps were inscribed for. An "illegal" use of a revenue stamp for say a mortgage that was used on a pack of playing cards may generate some interest with added value. After December 25, 1862, the restriction was lifted, and revenue stamps could be used on anything requiring their use regardless of the inscription.

Have you checked the two names on the note? You never know what you may find.

Login to Like

this post

I might pay $10 for the document, just because of the use of three different stamps to make up the correct 15-cent tax on a $300 promissory note. But that's just me. Otherwise, I would agree that, since it is not particularly attractive and there is no other feature of special interest, the value would be determined primarily by the value of the stamps and the condition of the document. Also, although it obviously doesn't apply in this case, there would likely be an enhanced value for any document legitimately dated prior to December 25, 1862, whether the use was "illegal" or not, because I don't believe many documents have survived from that brief early period after the Revenue Act took effect on October 1, 1862.

Login to Like

this post

Somewhere between $5-15 would be my estimate. If it were an EMU (early matching usage) from 1862 or early 1863 it would have more value, or if it were an unusual rate or locale.

1 Member

likes this post.

Login to Like.

thank you all for you help and insight and the explanations for your answers.... i appreciate it, and I'll sound really smart when I tell my friend all I've learned.

Login to Like

this post

"It would be my thought that ordinarily for revenue stamp usage that there would not be that much of a value increase for the stamp on piece."

Ah, but those stamps are much more interesting on a document. I haven't delved into US Revenues yet, but I've noticed how pretty many of them are. As part of my USA collection, I had decided that I'd rather have some categories used on cover, rather than as mint stamps. That includes early airmails, zeppelins, special delivery and postage due. I can add revenues to that list now!

Login to Like

this post

"It would be my thought that ordinarily for revenue stamp usage that there would not be that much of a value increase for the stamp on piece."

On piece no, but on complete documents, absolutely... in the same way that on-cover frequently raises the value of early postage stamps: there aren't that many remaining intact. It will depend on the stamp and the document, i.e., a 2-cent 1st issue revenue on a check is a very common item, normally $1-3 at retail.

Being used on document can also confirm authenticity of imperf and part perf revenues that might otherwise not be considered legitimate due to margins.

Certain combinations of stamps are hard to find, and aesthetic combinations also play a part.

Take, for example, R30c, the 6-cent Inland Exchange, cataloging $2.25. On-document usages are very hard to find. Run-of-the-mill examples will set you back $40-100. Because it is an odd denomination, almost all you encounter will be combination usages with other revenue stamps. Find a solo usage on a document and you have something truly scarce.

1 Member

likes this post.

Login to Like.

Auctions

Hi all, my friend from the stamp club knows everything about Germany and its states and virtually nothing about US revenues. We overlap on one of those qualities.

He asked me to help with this promisary note. It's franked with Scott R1, R20c, and R36c (I'm assuming no valuable paper varieties). On eBay, promisary notes seem to be priced low except for the tall revenues. The CV for these three as unsed stamps is $3.70. does anyone know if being on note brings the price up significantly, and how much? Any help is appreciated.

David

Login to Like

this post

02:49:51pm

re: promisary note: how to value

David.

I sent an email, with a copy of this post, to a friend of mine in Mass. who specializes in US revenue B.O.B. stamps.

If he is able to shed any light on this, I will post his response to this thread.

Login to Like

this post

re: promisary note: how to value

It would be my thought that ordinarily for revenue stamp usage that there would not be that much of a value increase for the stamp on piece. Of course if you had a famous person's or company name on the document, then you'd probably get a bump in value.

Revenue stamps up to December 25, 1862 could only be used on the document, instrument, etc. that the stamps were inscribed for. An "illegal" use of a revenue stamp for say a mortgage that was used on a pack of playing cards may generate some interest with added value. After December 25, 1862, the restriction was lifted, and revenue stamps could be used on anything requiring their use regardless of the inscription.

Have you checked the two names on the note? You never know what you may find.

Login to Like

this post

re: promisary note: how to value

I might pay $10 for the document, just because of the use of three different stamps to make up the correct 15-cent tax on a $300 promissory note. But that's just me. Otherwise, I would agree that, since it is not particularly attractive and there is no other feature of special interest, the value would be determined primarily by the value of the stamps and the condition of the document. Also, although it obviously doesn't apply in this case, there would likely be an enhanced value for any document legitimately dated prior to December 25, 1862, whether the use was "illegal" or not, because I don't believe many documents have survived from that brief early period after the Revenue Act took effect on October 1, 1862.

Login to Like

this post

re: promisary note: how to value

Somewhere between $5-15 would be my estimate. If it were an EMU (early matching usage) from 1862 or early 1863 it would have more value, or if it were an unusual rate or locale.

1 Member

likes this post.

Login to Like.

Auctions

re: promisary note: how to value

thank you all for you help and insight and the explanations for your answers.... i appreciate it, and I'll sound really smart when I tell my friend all I've learned.

Login to Like

this post

Approvals

re: promisary note: how to value

"It would be my thought that ordinarily for revenue stamp usage that there would not be that much of a value increase for the stamp on piece."

Ah, but those stamps are much more interesting on a document. I haven't delved into US Revenues yet, but I've noticed how pretty many of them are. As part of my USA collection, I had decided that I'd rather have some categories used on cover, rather than as mint stamps. That includes early airmails, zeppelins, special delivery and postage due. I can add revenues to that list now!

Login to Like

this post

re: promisary note: how to value

"It would be my thought that ordinarily for revenue stamp usage that there would not be that much of a value increase for the stamp on piece."

On piece no, but on complete documents, absolutely... in the same way that on-cover frequently raises the value of early postage stamps: there aren't that many remaining intact. It will depend on the stamp and the document, i.e., a 2-cent 1st issue revenue on a check is a very common item, normally $1-3 at retail.

Being used on document can also confirm authenticity of imperf and part perf revenues that might otherwise not be considered legitimate due to margins.

Certain combinations of stamps are hard to find, and aesthetic combinations also play a part.

Take, for example, R30c, the 6-cent Inland Exchange, cataloging $2.25. On-document usages are very hard to find. Run-of-the-mill examples will set you back $40-100. Because it is an odd denomination, almost all you encounter will be combination usages with other revenue stamps. Find a solo usage on a document and you have something truly scarce.

1 Member

likes this post.

Login to Like.